Adobe released their Fiscal Year 2013 numbers today, and though the Q3 earnings were below expectations, Adobe seems to have rebounded in Q4 and just matched their targeted range of $1 billion to $1.05 billion, resulting an increase in stock value in after-hours trading.

Some fourth quarter financial highlights for the digital arts, marketing and media behemoth:

- Adobe achieved revenue of $1.04 billion, within its targeted range of $1 billion to $1.05 billion.

- Adobe exited Q4 with 1 million 439 thousand paid Creative Cloud subscriptions, an increase of 402 thousand when compared to the number of subscriptions as of the end of Q3 fiscal year 2013, and enterprise adoption of

- Creative Cloud was stronger than expected.

- Creative Annualized Recurring Revenue (“ARR”) grew to $768 million, and total Digital Media ARR grew to $911 million.

- Adobe Marketing Cloud quarterly revenue was $316.2 million, representing 38 percent year-over-year growth.

- Diluted earnings per share were $0.13 on a GAAP-basis, and $0.32 on a non-GAAP basis.

- Cash flow from operations was $315.0 million.

- Deferred revenue grew by $94.7 million to a record $828.8 million.

- The company repurchased 7.9 million shares during the quarter, returning approximately $405 million of cash to stockholders.

And some fiscal year notes:

- Adobe achieved revenue of $4.06 billion and generated $1.15 billion in cash flow from operations during the year.

- Creative Cloud subscriptions grew by 1.1 million and Document Services subscriptions doubled to more than 1.6 million. In addition, the company added more than $700 million in Digital Media ARR during the year.

- Adobe Marketing Cloud achieved a record $1.02 billion in annual revenue, representing 26 percent year-over-year growth.

- The company repurchased 21.6 million shares during the year, returning approximately $1 billion of cash to stockholders.

In 2012, Adobe achieved record revenue of $4.4 billion and 2013 did not break that record. Their Q4 earnings were basically the same when we look at last year. That said, despite widespread grumbling from the photographer community and a serious attack on Adobe servers that compromised customer password information, it seems that Adobe isn't feeling too hard of a pinch when it comes to cash flow and earnings as their total income fell only marginally, something that is likely to easily be made up in the coming months. It can also be inferred that the "Photographer Bundle" Adobe peddled late in November had some impact on the numbers, especially when we look at the Q3 stats as well as Adobe's extension of that bundle beyond the original date. Why they won't make it a permanent fixture in their pricing options is a mystery (despite holding it as an "ace" in their sleeve when they need to quickly infuse more cash at the end of a fiscal period).

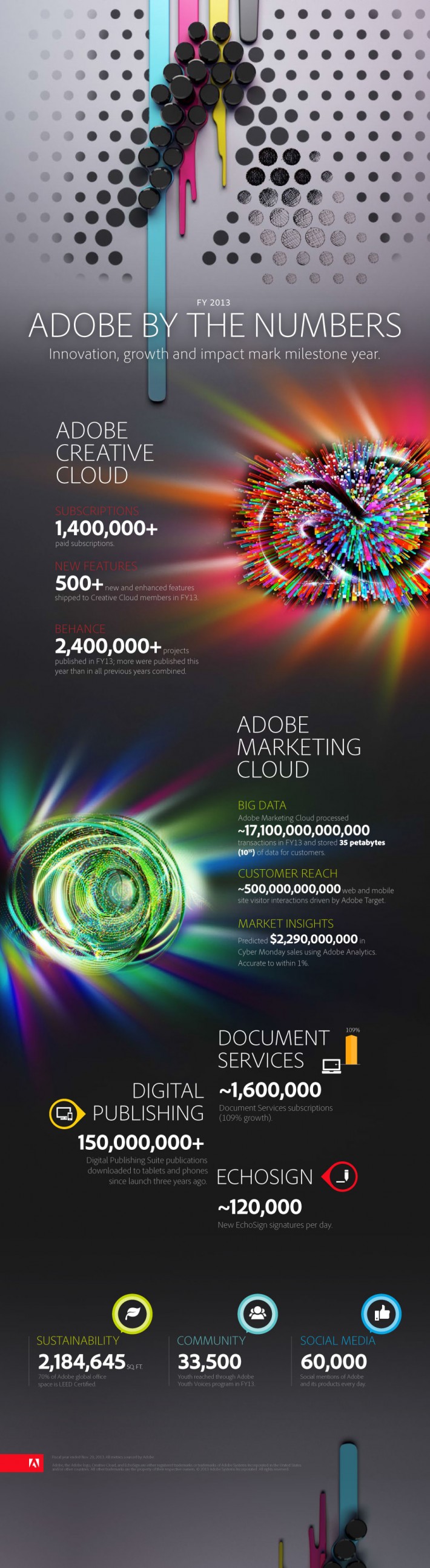

To elaborate on more besides just financial numbers, Adobe also released this infographic (click for larger):

Thanks for the info.. but I thought this was a photo blog.. not marketwatch.com.

Adobe being successful is rather important to the photography/videography market don't you think?

I stand by my comment.. I think filling Fstoppers with fluff instead on concentrating on actual photography related content has been very evident. Good day!

I should know better than trying to spell this out for you because it's blindingly obvious, but if the maker of one of the most important tools in a photographer's stable is unhealthy, or successful via a certain business model, which effects you as a photographer, that would be the purview of a photography blog to cover. What happens to that company, or any other company that I have an ongoing purchasing relationship with as far as my work goes, is 100% appropriate because it effects HOW I DO PHOTOGRAPHY.

I also should know better than to spell it out for you since it's blindingly obvious, but there's a big difference between "effects" and "affects".

YOU NAILED IT! I can definitely see how my point is null and void now, flawless comeback.

Caps lock should be null and void.

But it's a good effect. :O

You're improving. ;).

What would be much more interesting than grammar squabbles would be to see a justification of why someone would regard a post about Adobe's financial performance as "fluff" in a year when they changed their distribution model in a very controversial way. I'm not particularly thrilled about the end of unlimited licenses for future products, which I might want to use someday, and to see how the new distribution model has performed is important in estimating what decisions I will have to make in the future.

At the end of the day, Adobe isn't going away any time soon. Unless they were in bankruptcy proceedings or were being taken over by another software company I think most photographers would agree this story isn't really photo blog worthy. If you think it is then they should start blogging about year end profit/loss reports of all major photography related companies. I highly doubt you would enjoy that. Merry Christmas.

Sorry you feel that way! I have also covered profits and distribution levels of major camera companies. It's something that shapes the future of the industry, and therefore many people find it helpful and interesting.