Nikon quietly — or maybe not so quietly given the press — announced the demise of the innocuously named Coolpix B600, a product name that just trips off the tongue and screams cheap and cheerful. What is startling about this camera is that it only hit the market in December 2020. Some eight months later it has bitten the dust. Why is this and what does it say about the camera market?

Like many of the stalwart manufacturers, Nikon has a long history with integrated cameras that dates back to the birth of digital. Compact and bridge cameras came long before DSLRs and many of the design standards we take for granted today originated during this period of development. Integrated cameras were introduced for the simple reason that they were... well, simple. This reduced costs for what were relatively expensive products at the time. The first fully integrated digital camera — the Fuji DS-1P — cost an extraordinary $20,000 which got you a 0.4-megapixel image and 2-megabyte memory card. Hardly exotic by today's standards but was unique in offering instant photography, digital transfer, and computer-based manipulation via the burgeoning Photoshop market.

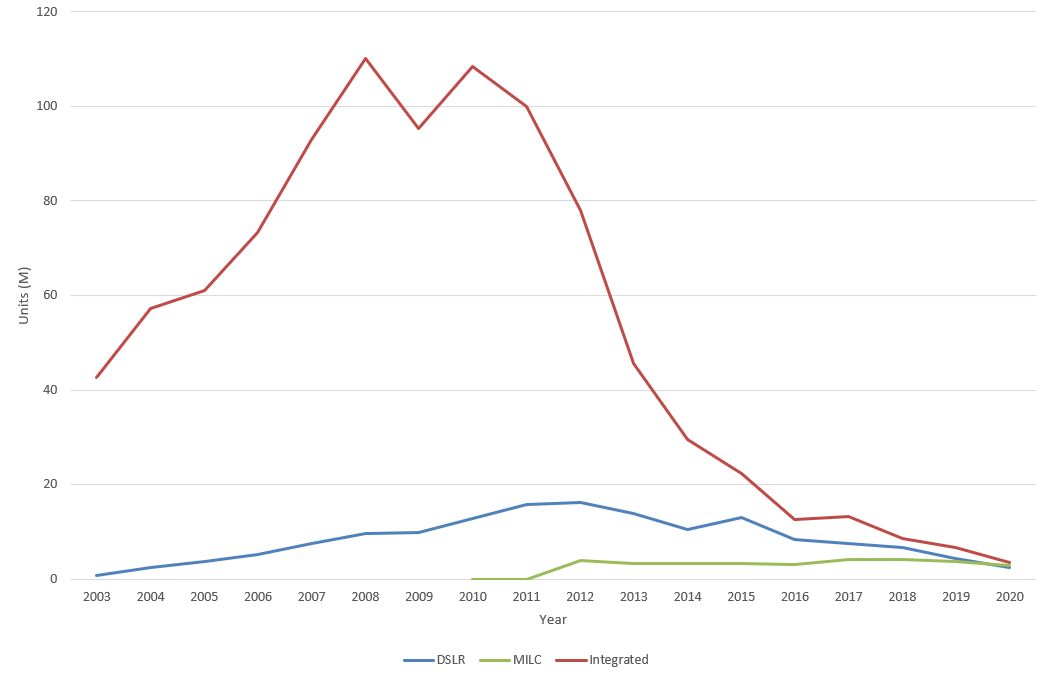

It took until 1999 for the DSLR to eventually appear in the form of the Nikon D1, at the significantly reduced price of $4,999, which allowed you to use all your existing Nikon F-mount lenses. Of course, by this point, integrated cameras were commensurately cheaper and appealed to the conspicuous consumer who had disposable income for electronic gadgets. I should know as this was when I bought my first digital camera, a moderately specified and priced Minolta DiMage compact. The 1990s and early 2000s were boom years for both compacts and camera manufacturers more broadly. Take a look at CIPA shipments of integrated, DSLR, and MILC cameras from when records were first available in 2003 and you'll see that by this point integrated models were already shipping 40 million units, valued at some ¥1,200 billion. Compare that to the combined film and digital SLR shipments which come in at 16 million units valued at ¥120 billion. The difference is stark: three times the cameras, totaling some ten times the value.

The integrated camera was where the money was at and every manufacturer wanted a piece of it. What became an extremely competitive sector is reflected in the rapid expansion in the production and shipment of integrated cameras to its 2010 peak of 120 million units. That's a 300% increase, but by value, this was worth ¥1600 billion, about a 33% increase. What this shows is that the average value of a camera plummeted from some ¥27,000 (about $230, not adjusted for inflation) to ¥9000 (about $80). It really was a "pile it high sell it cheap" mentality and its demise was equally rapid. By 2020 only 3.5 million units shipped at a value of ¥60 billion, although the average cost had risen slightly to ¥17,000. Crucially, while they still make up 40% of shipments they only represent some 20% by value which is probably indicative of the low-profit margins on these models.

The Nikon Coolpix B600

So where does the Nikon Coolpix B600 fit into this story? The Coolpix brand is long-lived and has produced some excellent high-quality cameras over the years. I've owned a few and enjoyed shooting with them. It's also produced some pretty threadbare offerings; budget affairs to entice novices into photography. In contrast, the Coolpix B600 is a thoroughly modern affair sporting a 16MP 1/2.3" BSI CMOS sensor that can shoot at 7 fps, as well as full HD video all with in-built vibration reduction, WiFi, and Bluetooth. The big selling point is the 40x optical zoom offering a 35mm equivalent of 22.5mm through to a remarkable 900mm at what was a relatively budget price of $330.

So what's the problem with this camera given that only eight months later it has been discontinued? The official line — which undoubtedly plays a significant role — are component shortages which means that production has had to be halted. What we don't know is how well this camera is selling globally, but given the continued decrease in integrated camera shipments and the low margins on these products, the decision has been taken to kill it while the drain on the business is relatively low. It's likely that the development and production costs won't be recuperated, but this is preferable — and particularly for Nikon at the moment which is trying to reduce costs — to an increasing burden on out-goings.

Looking at Nikon's current Coolpix lineup we can see that there are only two ranges: bridge and compact. The compact cameras are either entry-level or tough cameras, so there is clearly some utility in offering a "hook" into the Nikon brand. With the B600 now officially gone, Bridge cameras (that are available) have been reduced to the B500 and P1000. These models offer extreme focal length reach (at the expense of image quality), although the integrated lens allows designers to improve performance relative to its absolute quality.

The problem is, of course, the smartphone which has largely stolen the market from the integrated camera. The key question is what utility the integrated camera can offer the end-user over and above the smartphone. Nikon's lineup suggests this can be divided into three areas: a first camera, a tough camera, and a super-zoom. The problem for manufacturers is that you are increasingly finding smartphones that are: a first smartphone, a tough smartphone, and a super-zoom smartphone. It's the last of these categories where camera manufacturers can still (optically) shine, but is there really still a market for them? If you have a decent amount of money to spend, will it be on a super-zoom or would you spend a little more and buy a mirrorless camera, then splash out on some exotic glass? This conundrum has foxed manufacturers for the best part of a decade now. Deep down they know the answer: the integrated camera is dead. It's just taken a while to spin down production. Nikon has perhaps led this charge more aggressively through its plant closures.

The focus of manufacturers is now clearly on mirrorless and the charts above illustrate why. While mirrorless shipments and value are largely static in absolute terms, this is in a decreasing market. In short, they now make up some 33% of shipments, but 54% of value. This is on the back of an increasing average unit cost of ¥56,000, which looks set to increase further, at least in the short term. Compare this to DSLRs that now make up 27% of shipments and 26% of value.

The Nikon Coolpix B600 is fundamentally illustrative of the problems facing manufacturers and its demise should be expected. The market has shifted to high-end mirrorless models; expect both the number of units and value to increase year-on-year as manufacturers cater to professional and wealthy amateur photographers. The era of the integrated budget camera is over.

Lead image composite courtesy Clker-Free-Vector-Images via Pixabay, used under Creative Commons.

"The compact cameras are either entry-level or tough cameras, so there is clearly some utility in offering a "hook" into the Nikon brand. With the B600 now officially gone, Bridge cameras (that are available) have been reduced to the B500 and P1000."

Have they actually discontinued these other cameras? Or is it just supply issues? When I look online plenty of Nikon cameras listed at various retailers yet, but many including the P1000 and rugged compacts are on back order or out of stock. Even most of the newer mirrorless cameras are out of stock/back ordered, etc and I know they aren't all discontinued.

I suspect that due to the declining sales of these types of cameras, the chip shortage is exasperating their decline. They've become a low priority.

A lot of companies are focusing on their more expensive products and ignoring the budget market due to the chip shortage, it's not just Nikon or the camera industry.

You gotta hand it to smartphone manufacturers and their marketing teams... What other business manages to sell people the same $1500 item every year by reusing the same line every time? And if the "our phone takes better pictures!" line doesn't get you, then the turtle like slowness of a slightly outdated phone will.

Smartphones do this. Cameras don't.

Contrary to the article (at time of writing) the B600 does max 1440mm equivalent zoom (max 900mm is the B500). Mainly, though, the actual problem with the B600 is the firmware. On the hardware side the B600 is fantastically capable. The main drawbacks are the missing viewfinder and the comparatively small aperture - but both come with the upside that the camera is small and light. On the software side the problem is that the firmware has been neutered. The two main things that are missing are manual focus and manual exposure. Of course Nikon doesn't want to spoil its own market for compact superzooms, but if I wanted a heavy 2000mm or 3000mm beast I would get one, and the only thing I see in the B600 is a company not making the best camera they are capable of. If they want to lament the downfall of the consumer camera, then they should at least make the best devices they know how. It's not as if Apple or Samsung are holding back on that front.

Occam's razor - Various digital parts, transister etc. are so back logged that it became unreasonable to continue to offer it if none can be made. Many manufactures are skipping/discontinuing models and focusing on the next release.