BCN Retail sales data offers a snapshot into the state of camera sales in the industry. January sees them release their awards for overall sales in the previous year, and this year is no different. So, who are the winners and losers?

BCN Retail collects online and in-store sales data across a range of high-tech industries, with cameras just one of the sectors they monitor. The detail of this sales data requires a subscription, but each January, they release annual awards for the highest sales, ranked by the top three performers, across a number of different product categories. For the camera category, the DSLR, MILC, and integrated sub-categories are the most relevant, although there are also video camera and action camera sub-categories too. It's also worth remembering that the data is for Japanese sales and only for retailers that report back to BCN. In short, they represent some 40-60% of domestic Japanese sales and can't cover the contextual detail of sales in the broader Asia region, Europe, or North America. However, Japan is representative of some 15% of total shipments, so what happens in Japan is important for the whole market.

For 2021, the integrated camera sub-category winner goes to Canon (39.1%), followed by Sony (19.7%) and Fuji (11.4%). In terms of units shipped, integrated cameras are the largest (6.5M units), and Japan is the single most important region, taking around 25%. Compared to 2020 (Canon 39.3%, Nikon 22.9%, Sony 15.2%), the most notable difference is Nikon dropping out of the top three with the appearance of Fuji. This is likely a result of Nikon's restructuring and reduced production in this category, broadly reflecting the drastic measures it is having to take to rein in costs while focusing upon its mirrorless lines. Sony and Fuji have benefited, taking market share as a result

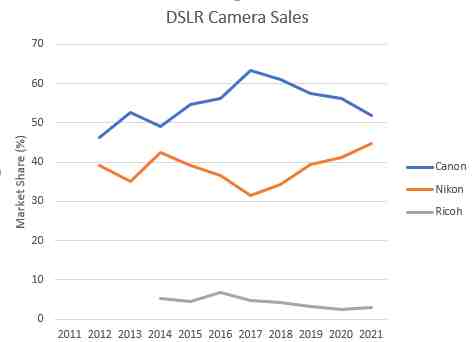

For the DSLR sub-category, Canon again remains top (51.9%), closely followed by Nikon (44.8%), with Ricoh trailing a distant third (3.0%). This is broadly on par with 2020 (56.3%, 41.1%, and 2.4% respectively), showing Nikon and Ricoh clawing back a little market share. The graph below shows how this has changed over the last decade and the broad success (in terms of market share) Nikon has had since 2017, although this has to be balanced against what is a diminishing market in terms of units shipped. DSLRs — and related lens sales — remain good business for Nikon and a key source of revenue; however, the fact that this is declining is a reason to act now and pivot to mirrorless. In fact, pivoting to mirrorless is exactly what Canon has done, which could reflect a lower-key emphasis on DSLRs than Nikon, hence the declining market share.

Perhaps the most coveted award is therefore for mirrorless. This goes to Sony (27.4%), followed by Canon (23.8%), and Olympus (23.4%), representing a switch from last year (Canon 30.9%, Sony 25.9%, Olympus 23.4%). There are two big takeaways here: firstly, Sony continues its long-term increase in market share, which is doubly important given that the sector is expanding and secondly, Olympus remains solidly in third place. The picture for Canon is complicated by its move away from the lower-priced EOS-M, along with the release of high-ticket items in 2020. Along with the impact of COVID-19, this will have perhaps had a disproportionate impact on its sales. Olympus continues to demonstrate the popularity of its models. Finally, the continued absence of Nikon in the top three shows how competitive the sector remains and that to generate revenue, it desperately needs to increase its market share here.

Beyond 2020

The impact of COVID-19 on businesses remains ongoing and will continue to reverberate long after a sense of normality eventually returns. This is just as true in the camera sector, so how each individual manufacturer responds as we edge further into 2021 will be fascinating to watch. Fuji, Sony, and Canon are all thriving in the mirrorless future that is now upon us. Ricoh (and specifically Pentax) appear to be wandering in the wilderness, with all eyes on the fortunes of Nikon and Olympus, while Panasonic creates there own niche. How will 2021 pan out for the camera sector?

Lead image a composite courtesy of MediaModifier via Pixabay, used under Creative Commons.

How is Fuji thriving in the "mirrorless future" if they didn't make the top three for mirrorless, and only have 11.4% of "integrated cameras" (which I assume means fixed lens)?