There is fierce competition among the top digital imaging companies, fighting for several billion in dollars worldwide. I have examined Olympus and Sony in the past, and this year I wanted to bring in Canon and Nikon to see how their last fiscal year treated them. Though the publicly filed information tends to be pretty vague in specific company categories (instead opting to give general aggregated sales), I was able to get some approximate final sales numbers in digital imaging for these four companies. Let’s answer the big question: who came out on top?

On April 22, 2013, Canon sent out a news release on their past fiscal year, specifically on their dominance in the interchangeable lens market. According to the release, they’ve been the market leader for ten straight years now. Upon closer inspection, this information was based only on Canon polling - not an independent source. One, I’m not a huge fan of companies tooting their own horn on how awesome they are. Two, I’m even less of a fan of it if it’s not based on a third party independent study.

I’ve been culling over the financial statements of the industry-leading digital imaging companies (Canon, Nikon, Sony and Olympus) since late March, but this statement put a fire under me. Now I was really curious: is Canon really that much of a market leader?

Figuring out who is the market leader specifically in DSLRs is a tall order when all I have is based on annual sales numbers released by the companies. Some are more specific than others, and Canon and Sony include more than just cameras in their “digital imaging” pools. None of the companies drill down so far as just DSLR sales. So though I urge you to take this with a grain of salt, what I’m showing here will let you see trends and gather a good idea of the situation at each company and the industry as a whole.

So let’s start at the bottom: Olympus.

Olympus has had a rocky past couple of years. They saw a nearly 50% falloff in enterprise value and a catastrophic -269% crash in revenue in less than a year between 2011 and 2012. They struggled with corruption and their former leadership straight up lied about the profitability of the company. Even with all that technically behind them, rebounding is a tall order. However, Olympus didn’t fall much.

“Fiscal 2012 brought higher sales, especially in Japan, Asia, and Europe, of high-value-added models such as the mainstay PEN series of mirrorless interchangeable-lens cameras and XZ-1 cameras, which deliver the highest image quality available from a compact camera. Nevertheless, full-year consolidated net sales fell year on year as a result of factors including intensification of competition and the inability to introduce the OM-D and other new products as scheduled because of parts procurement difficulties in the second half due to the flooding in Thailand. Operating loss decreased thanks to improvements in the cost of sales ratio and cost reductions.” That bit about the parts procurement meant that they couldn’t meet the production demand, therefore were unable to sell as many cameras as they feasibly would have been able to with better production output. That’s sad to hear, because that might have pulled Olympus up beyond fiscal year 2011.

What all that means was their imaging division was down, but marginally so. They sold approximately $1.157 billion in digital cameras in the 2012 fiscal year, down just slightly from the approximate $1.169 billion in sales the previous year. They haven’t stopped the fiscal bleeding, but they have slowed it down considerably. This is a good sign, and I have high hopes for Olympus in the future if they can keep their nose to the grindstone and really focus on a killer 2013. With the super success of their OM-D and Pen-series cameras, I have to think that they can maintain that momentum as this year continues especially if their production lines can keep up with demand.

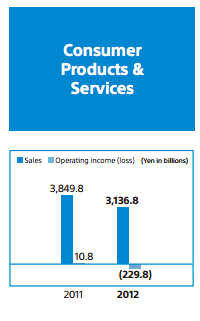

Next up is Sony, who a year ago was leaning heavily on its imaging division to bring up truly abysmal sales in its television market. In their 2011 Annual Report, Sony went so far as to say the future was in their digital imaging (despite heavy losses in this area). Based on their annual report from 2012, those TV sales are still struggling big time, and their digital imaging isn’t doing much to save it. In fact, their digital imaging sales are down 18.5% over the previous fiscal year from $12.986 billion to $10.584 billion (These numbers are based on percentages of given sales numbers, since digital imaging is lumped in with Consumer Products and Services, but was shown to be 16.3% of that business).

Sony reported “sales to outside customers decreased 18.8% year-on-year. LCD television sales declined, reflecting lower unit sales and price declines, largely as a result of market contractions in Japan and the deterioration of market conditions in Europe and North America. Sales of PCs and digital imaging products, including digital cameras, were also down, mainly reflecting the impact of the floods in Thailand and unfavorable foreign exchange rates. Lower sales of PlayStation 3 hardware, due to a strategic price reduction, and of PlayStation 2, due to platform migration, led to a decrease in sales in the game business.”

For Sony fans, this is not the best news. An operating loss of ¥229.8 billion was recorded, compared with operating income of ¥10.8 billion in the previous fiscal year. That’s a pretty steep turnaround, and one that doesn’t instill a whole lot of confidence. Sony’s President and CEO Kazu Hirai promises that “Sony will change” and that it is “reinventing itself to deliver new and exciting experience to [its] customers around the world.” That’s all well and good Hirai, but I really want to see that reflected in the company numbers. You keep promising improvement but not delivering. Things don't seem to be getting better, and that's troubling (especially since I love my PS3).

With those two aside, let’s turn to Nikon and Canon, considered by many to be the industry leaders in digital imaging.

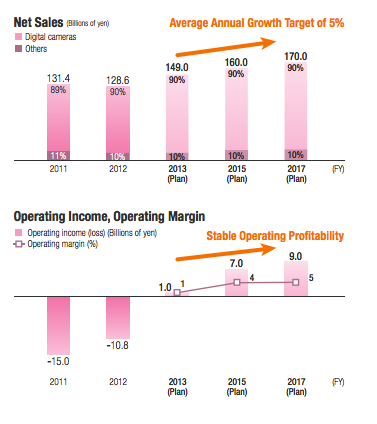

Nikon had a pretty good year, especially considering the flooding issue that really hurt both Olympus and Sony. “In the fiscal year ended March 2012, although the flooding in Thailand and strong Yen had a considerable impact on performance, Nikon achieved increases in both revenue and earnings overall. The results in the Imaging Products Business were affected by the Thailand flooding, but this was covered by greater revenue and a sharp rise in earnings in the Precision Equipment Business.”

What that means is that Nikon saw a slight decline in sales from its imaging business. They don’t give exact numbers, but based on a graph we can see that in 2011 they reported about $5.9 billion in sales and just around $5.8 billion in 2012. That’s not too shabby, but I did hope for better from Nikon. Their recent cameras are the talk of the town (and dominate the DxO scores if you’ve checked there lately). What’s important to note though is that even though their numbers are lower than what I calculated from Sony and Canon (below), their digital imaging is basically all cameras and lenses. The same can’t be said for Canon and Sony who lump in other products into that category, skewing the data for those of us interested only in their camera sales and making Canon's market share and sales numbers appear over double Nikon's (which isn't the case).

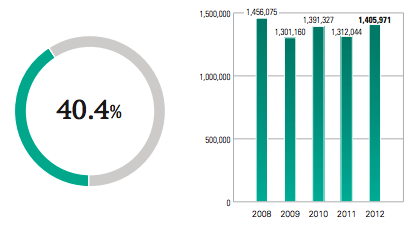

Canon’s structure is more comparable to Sony than Nikon. They have a lot of divisions, and their digital imaging sector includes digital cameras, digital camcorders, digital cinema cameras, interchangeable lenses, inkjet printers, and calculators. That’s a lot more than just cameras and lenses like we find in Nikon’s case. It’s no wonder that their 2012 sales were around $14.06 billion. That’s up pretty significantly (7.2%) over 2012, which reported $13.12 billion in sales. Even though there are more than cameras in this division of their company, they are the only company of the four who has reported a growth in sales over last year.

Canon reported that “the advanced-amateur models, EOS 5D Mark III and EOS 60D, as well as the entry-level EOS Rebel series drove sales beyond the previous year’s level both in volume and value terms.” They also reiterated their stranglehold on shipping the most interchangeable-lens digital cameras. They go on to admit that video camcorders are facing a downtrend in global demand. No surprise there. Canon has made up for the lower sales in that department with strong DSLR and printer sales. Canon also “enjoyed greater demand from domestic broadcasters and received numerous inquiries in Europe associated with large-scale sporting events. Accordingly, sales of broadcast equipment increased in 2012, driven by the DIGISUPER 95 field zoom lens.”

Note: The 40.4% above is the percentage of the Canon business dedicated to digital imaging. Compare that to Nikon's 63.9% and you can see how massive of a company Canon has become. For Sony, digital imaging only makes up a little more than 16% (again, makes the company's massive size apparent), and for Olympus their digital imaging is 15.1% of the business.

Canon has recognized their dominance, and doesn’t plan to let up: “The market for interchangeable-lens digital cameras is expected to grow around 10% annually for the foreseeable future. In this context, Canon plans to maintain its strong competitiveness and become the overwhelming No. 1 player.”

So let’s review… for these four major brands, digital imaging sales worldwide were as follows:

Olympus: Approximately $1.157 billion (down from $1.169 billion)

Sony: Approximately $10.584 billion (down from $12.986 billion)

Nikon: Approximately $5.8 billion (down from about $5.9 billion)

Canon: Approximately $14.06 billion (up from $13.12 billion)

So back to my original questions: Who came out on top? I guess we go with Canon, who was the only one to show growth over last year. Does Canon hold the number one share of the global interchangeable-lens market? Probably. I can’t find any data that would refute that. Please don’t read too much into my words, even though I am a Canon shooter I’m not playing favorites here. I’m just reporting the facts.

What do you want to see out of these players in the coming year? Who did I not mention here that you think is primed for a huge upswing in market share? Let us know in the comments below.

![[Editorial] Can Sony's Digital Imaging Division Restore Profits?](https://cdn.fstoppers.com/styles/small-16-9/s3/wp-content/uploads/2012/04/SONYoped2.jpg)

Man I love cheese.

The 5D3 is an advanced amateur camera? lol

Yes, Canon themselves do not consider 5D or 6D level bodies professional models.

Surely they do? Haven't CPS always considered the 5D's to count as pro bodies?

While 7D is a professional model?

They want 2 professional models, a Full Frame and an APS-C.

I don't know if they are going to launch any second professional ultra high resolution camera, but this is it. The thing that a i don't understand is what physicaly do to diferenciate, on FF they use the body with the integrated grip and the better material. But why they don't do it in the APS-C model?

Makes sense. 60D has higher spec than a 6D despite being not a fullframe.

Full frame are always more expensive than APS-C DSLR...even the pro level APS-C DSLR.

I guess they really wants to make sure the customer satisfied with the amount they paid on FF cameras.

But isn't 7D is a very tough camera? Sometimes they make a DSLR without integrated battery grips just to make us pay more to get one.

Just look at Sony RX1. The camera itself is expensive, but still it have other expensive accessories that you need to buy (if only you need the viewfinder)

Of course I understand you! ^^ I'm from Malaysia myself!

7D in my mind is the actual professional canon APS-C on the market, 1DX the professional Full Frame.( I don't understand why nikon and canon are holding so much to put the new professional APS-C.)

You are probably right, without the integrated battery grip on APS-C pro cameras they can sell at a lower price than you buy the grip if you want it. They do make profit on these acessories, The RX1 i don't think it's that expensive because everything on that camera is really valueable, try to buy a FF with a zeiss 35mm 2.0 that does "macro". You can say to me that the RX1 is not speedy as the dslr FF, but no dslr has this size, so i think is some trade of.

I just feel if i had the money to buy i would buy the RX1.

Thx Norshan for Replying

No problem at all. RX1 indeed is an awesome camera. Never had a chance to test it yet. Size does matter, the smaller the camera the less people concern about it. Except spycams :P

Oh okay, nice knowing you too!~

You forgot to include Pentax!

Pentax is a tricky beast, because they are owned by Ricoh who lumps their printers and copiers into their imaging business (a business that is much much larger than their camera business). However, since you asked, the numbers they are revealing state: "Sales in this category decreased by 3.9% as compared to the previous corresponding period, to ¥1,471.8 billion."

You can peruse their financial statements here: http://www.ricoh.com/IR/financial_data/financial_result/data/24/flash.pdf

Thanks for the response, Jaron. You're right, lumping those other factors into their business model isn't saying much about the state of Pentax. Hopefully they'll change things around and have a more detailed report for Pentax on their next annual report.

Olympus has fallen. It was even made into a movie. Jk lol

Note that these figures are pre-OM-D. Olympus should see much more improvement in the next reporting period based upon the success of the OM-D and later products using the Sony-sourced sensor.

That was a joke.

I do feel pretty confident that they will definitely make leaps and bounds as a company. I was just joking about the name itself. >.>

And Fujifilm is where????

Excluding dedicated video, industrial, and scientific camera sales, Nikon beat Canon imaging sales hands down. But, Canon is still ahead of Nikon on camera quality and openness to consumers, and that could drive conversions going forward.